Partnered

With

ERC for Self-employed | ERC Self Employed | ERC for Self Employed | ERC Credit for Self Employed

Also known as the ERC for the Self Employed/ Contractor Workers/ 1099/ Gig Workers

Get Tax Refund

Up to $32,000 Dont Wait!!

Unlock the quickest, most secure, and simplest solution crafted by our team of tax professionals, designed specifically for self-employed individuals and sole proprietors to access the federal FFCRA tax credits rightfully theirs.

About 80% of self-employed workers are unaware of their eligibility, resulting in millions of dollars left unclaimed.

No upfront investment

1099 Together thrives on collaboration, we specialize in SETC Consulting Services while operating as a contingency-based program. We only succeed when you do. Our shared success model ensures that our efforts are fully dedicated to achieving favorable outcomes for your business. When you win, we win! Let's work together to drive your business towards new heights of prosperity.

This refund can replenish the losses of the pandemic.

Lets see what you qualify for?

Turnkey

Our specialized team is fully dedicated to this program, We are SETC specialists ensuring a seamless process for filing your refund. With our expertise and commitment, we streamline the refund process, making it easy and efficient for you. We handle the complexities, while you focus on the benefits of getting your refund promptly and hassle-free while completing your Self Employment Tax Credit (SETC).

Audit Protection

1099 Together offers an exceptional 5-year audit protection plan, providing unparalleled support to your business. With our seasoned team of professionals, we ensure accurate tax filings and compliance, safeguarding your business from potential audit risks for five years. At 1099 Together, its our business to help your business with your Self Employment Tax Credit.

Lets get you back to full recovery

Instant Payout for Qualified Business owners

Waiting for your funds is a thing of the past. Thanks to our hedge fund partnerships, qualifying business owners can now enjoy instant payouts. Say goodbye to lengthy delays, as our determined Self Employment Tax Credit specialist look to provide you with the financial resources you need when you need them most.

What is the Self Employment Tax Credit (SETC) Also Known as The Families First Coronavirus Response Act (FFCRA)

Congress designed the Families First Coronavirus Response Act (FFCRA) as a pivotal measure to aid independent business owners, including sole proprietors, freelancers, and gig workers, throughout the pandemic, with the collective vision of building a more robust future. At 1099 Together, we understand the significance of the Self-Employment Tax Credit (SETC) embedded within the FFCRA framework. As the sole program returning cash directly to the self-employed, the SETC is a crucial lifeline for individuals navigating the challenges of these unprecedented times.

Our dedicated team at 1099 Together specializes in facilitating the filing process for the SETC, ensuring that self-employed individuals harness the full potential of this unique government initiative. Unlike a loan, the SETC is a straightforward refund of the taxes you've already paid, offering direct financial relief. Recognizing the intricacies of the Employee Retention Credit (ERC) for self-employed individuals, we simplify the process, making it accessible for sole proprietors and freelancers alike.

Whether you're seeking guidance on Form 7202, exploring the nuances of ERC tax credits for the self-employed, or maximizing your benefits through the FFCRA, 1099 Together is your trusted partner. Our expertise extends to various facets, including the Employee Retention Credit for self-employed individuals, ensuring that you receive the support you deserve. Unlock the potential of the SETC and navigate FFCRA claims seamlessly with 1099 Together – where empowerment meets expertise for the self-employed.

Self Employment Tax Credit seem too good to be true?

Absolutely accurate! Crafted by Congress, the Families First Coronavirus Response Act (FFCRA) is meticulously designed to support individuals like yourself—sole proprietors, freelancers, gig workers, and independent business owners—as you embark on the journey to rebuild and enhance your professional endeavors. Whether you're recovering from the impacts of COVID or aspiring to elevate your work to new heights, the FFCRA is tailored to provide the support you need. If this information is new to you, that's completely understandable.

It's noteworthy that over 80% of self-employed individuals are unaware of their eligibility for FFCRA tax credits, according to studies. Initially intended for traditional employers and their employees, Congress subsequently expanded the FFCRA Act's scope to include self-employed individuals for the first time (Sections 7002(a) and 7004(a) of Public Law No. 116-127). The time to take action is now! To secure a refund on your 2020 taxes, the deadline to amend your return is April 15, 2024. For those looking to file a refund on their 2021 taxes, the deadline extends until April 15, 2025.

Not sure if you qualify?

Did you Miss Work due to:

Quarantine

Federal, state, or local lockdown orders related to COVID-19

Quarantining or isolation order related to COVID-19

Childcare

Caring for your child whose school had closed or gone virtual

Caring for your child because your child care provider was unavailable due to COVID-19

Illness

Symptoms of COVID-19 or seeking a medical diagnosis

Sickness due to vaccination side effects

Caring for someone with COVID symptoms

Vaccination

A COVID-19 vaccination appointment

Side effects due to vaccination

Who is Eligibile?

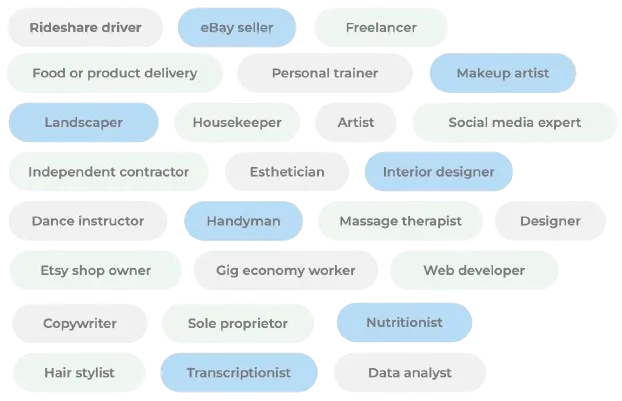

How do I know if I’m considered to be self-employed in 2020 or 2021? Were you a:

Who qualifies for the FFCRA tax credits?

To qualify for the FFCRA, you must meet the following criteria: - You must identify as a Self-employed individual. A few examples include: sole proprietors, independent business owners, 1099 contractors, freelancers, gig workers, single member LLCs. - Have filed a Schedule SE of IRS Tax form 1040 in 2020 and/or 20201 with a positive net income and paid self-employment tax on your earnings. - You missed work due to COVID-19 related issues

What qualifies as a reason for me claiming FFCRA?

To qualify for FFCRA tax credits you must have missed self-employment work due to COVID-related issues. If you were unable to work because of one of the following reasons, you may be eligible: - A government agency imposed a quarantine or isolation order. - Your doctor recommended you self-quarantine. - You were having COVID-19 symptoms while also waiting for an appointment with your doctor. - You were waiting for COVID-19-related test results. - You were getting vaccinated against COVID-19. - You were experiencing side effects from the COVID-19 vaccine. - You took care of your children who were affected by school or daycare shutdowns. - You took care of someone else/family member who had COVID-19 issues.

What dates are eligible for FFCRA tax credits?

The FFCRA covers the days you were unable to perform self-employment work during the time period of April 1, 2020 - September 30, 2021. Here is a breakdown of the amount of days you could be eligible: Childcare related time off - up to 110 days - 50 days between April 1, 2020 and March 31, 2021 - 60 days between April 1, 2021 and September 30, 2021 Yourself or loved one - up to 20 days - 10 days between April 1, 2020 and March 31, 2021 - 10 days between April 1, 2021 and September 30, 2021

What does it mean to be self-employed?

As defined by the Internal Revenue Service (IRS), a self-employed person is generally considered someone who: - You carry on a trade or business as a sole proprietor or an independent contractor. - You are a member of a partnership that carries on a trade or business. - You are otherwise in business for yourself (including a part-time business or a gig worker). 1099 Together works with sole proprietors, independent business owners, 1099 contractors, freelancers, gig workers, and single-member LLCs. We also work with individuals across all industries, including: realtors, uber drivers, hair stylists, online marketers, barbers, graphic designers, Ecom store owners, construction workers and many more.

Do I qualify for FFCRA tax credit if I already received unemployment benefits?

You can still qualify for the FFCRA tax credit even if you received unemployment benefits. However, you cannot claim the days you received unemployment benefits as days you were not able to work due to COVID-19 related issues.

Can I claim FFCRA tax credits if I am also a W2 employee?

You may still be eligible to claim FFCRA tax credits as long as you earned self-employment income in addition to your W2 salary during 2020 and/or 2021. If you are also a W2 employee and your employer filed for FFCRA credits on your behalf, we may not be able to help you. If you receive paid leave benefits as an employee, it may affect the amount of tax credit you can claim as a self-employed individual under the FFCRA. You cannot claim a double benefit for the same period. However, if your situation as an employee doesn't provide full coverage, there might be potential to claim additional credits based on your self-employment income.

Do I qualify for FFCRA tax credit if I already received Sick & Family Leave?

Unfortunately, if you have already received Sick & Family Leave credits for 2020 or 2021, you do not qualify for FFCRA tax credits. If you believe you might be entitled to more sick & family leave credits, we encourage you to speak with a CPA or Tax attorney.

Claiming Your Self Employment Tax Credit Refund (SETC)

Claiming your SETC has never been easier

Elevate your experience with 1099 Together, the leading company that not only excels in providing seamless filing for the Self-Employment Tax Credit (SETC) but also brings a unique advantage to the table – direct connections to hedge funds. As the unparalleled expert in the field, 1099 Together not only simplifies the SETC filing process but also facilitates a swift and efficient payout, offering a distinct advantage over the conventional waiting period for checks from the IRS.

Our exclusive connections to hedge funds enable us to offer a turnkey service, streamlining the filing process and ensuring that you experience a hassle-free journey to maximize your benefits. We understand that time is of the essence, especially for busy self-employed professionals who need quick access to the funds owed to them due to the challenges brought about by COVID-19.

By choosing 1099 Together, you are not just opting for a filing service; you are gaining a strategic partner with direct access to financial resources. This unique advantage allows for a rapid turnaround, providing you with the funds you deserve without the extended waiting period typical of traditional IRS payouts. Our streamlined process, coupled with hedge fund connections, sets us apart as the go-to solution for self-employed individuals seeking a quick and efficient resolution to their tax credit filing needs.

The Employee Retention Credit (ERC) for self-employed individuals, often referred to as the self-employed ERC credit, becomes even more valuable when complemented by 1099 Together's strategic connections. Our commitment is not just to simplify the filing process but to enhance your overall experience, ensuring that you not only receive the maximum benefits but also access them promptly.

In a landscape where time is money, 1099 Together stands out as the optimal choice for those seeking a comprehensive and efficient solution for SETC filing. Trust us to handle the complexities of the process, leverage our connections to hedge funds, and experience a swift payout that allows you to focus on what matters most – your business and the financial support you deserve. With 1099 Together, your SETC filing becomes a seamless journey toward maximizing your benefits and achieving financial peace of mind.

Our Reviews from Customers

Its our business to help yours

1099 Together is powered by a customer centric mindset, top-of-the line talent, and experienced leadership from the world's most trusted brands. That’s how we’re able to achieve our mission of helping thousands of businesses across the country with there erc consulting services.

Get in touch with 1099 Together Today

Recovering your self employment tax refund starts here with our SETC claims advice at 1099 Together, we've achieved an impressive average tax refund of $9,000 for our clients, showcasing the substantial financial impact of the Self Employment Tax Credit (SETC) program.

The potential awaiting your business is significant, and you can quickly estimate your refund in just a few minutes with no commitment necessary. Our team of SETC specialists is dedicated to providing guidance through this efficient assessment process, ensuring you understand the potential benefits for your unique circumstances.

Act now by giving us a call because, as this invaluable program may not be available indefinitely, taking advantage of it sooner rather than later could make a substantial difference for your business. Don't miss out on the chance to unlock the financial support your business needs — connect with 1099 Together today.

Want to Speak to a Team Member?

Fill out this Form & We will get in touch with you.

Am I eligible for the SETC?

About 80% of self-employed workers are unaware of their eligibility, resulting in millions of dollars left unclaimed.

Partnered with:

Frequently Asked Questions about SETC

What is the FFCRA tax credit program by the IRS?

In March 2020, the Families First Coronavirus Response Act (FFCRA) was enacted into law to aid companies in furnishing paid sick leave and unemployment benefits resulting from the impact of COVID-19. Initially, the FFCRA primarily targeted employers with W-2 employees, offering support to navigate the economic challenges triggered by the pandemic. Subsequently, in December 2020, Congress approved the Coronavirus Aid, Relief, and Economic Security (CARES) Act, extending the coverage of the FFCRA to include not only employers but also self-employed individuals. Thanks to this expansion, self-employed individuals, freelancers, independent contractors, and gig workers are now eligible for tax credits that reimburse them for the income lost during periods affected by COVID. The FFCRA constitutes federal legislation crafted in response to the COVID-19 pandemic. It encompasses provisions for paid sick leave, free COVID-19 testing, food assistance, unemployment benefits, and mandates protection for employer-provided health insurance. For self-employed individuals, the legislation extends equivalent coverage through tax credits, which can be claimed on their income tax returns, effectively reimbursing them for periods of sick leave attributable to COVID-19.

How much is the FFCRA credit?

The FFCRA Tax credit, with a maximum potential value of $32,200, is determined by your self-employed net earnings in the years 2020 and 2021. To compute your FFCRA credit, we employ the daily average of your self-employment income, calculated as your net earnings for the taxable year divided by 260. Additionally, we consider the extent of self-employment work missed due to COVID-19-related issues. This calculation enables the IRS to approximate the income lost for each day you were unable to work, providing a basis for determining the credit amount.

How come I haven't heard of the FFCRA tax credits before?

At first, the FFCRA targeted employers with W-2 employees. Although the CARES Act, passed later in the same year, expanded the provision of tax credits to include the self-employed, this extension was not extensively promoted. Studies indicate that more than 80% of self-employed individuals are uninformed about their eligibility for FFCRA tax credits.

Is this similar to the PPP program?

The Paycheck Protection Program (PPP) and the Families First Coronavirus Response Act (FFCRA) represent separate initiatives addressing the economic repercussions of the COVID-19 pandemic. PPP aids small businesses through the provision of loans, with the possibility of loan forgiveness. In contrast, FFCRA is not a loan but rather a tax credit applicable to taxes individuals have already paid. While PPP is geared towards supporting businesses, FFCRA is specifically designed to assist individuals.

How is the credit amount determined?

The sum you are eligible to receive is contingent on your average daily self-employment income and the count of days you were unable to engage in self-employed work due to COVID-related issues, encompassing government quarantine orders, self-quarantine, COVID-19 symptoms, and the pursuit of medical diagnosis. The credit for the childcare portion is calculated by multiplying the number of days on leave and taking whichever amount is smaller: • Your average daily self-employment income of year or: • $511. The credit for missing work due to a personal COVID-related issue or due to taking care of another person with COVID is calculated by multiplying the number of days on leave and taking whichever amount is smaller: • ⅔ of your average daily self-employment income or: • $200. A 1099 Together professional walks you through these simple steps and calculates your maximum FFCRA tax credit for you.

What is the average FFCRA refund that people are receiving?

The average refund from a 1099 Together client has received an FFCRA refund of $9,000.

How will I receive my FFCRA refund?

The IRS will send you a check for your 2020 and/ or 2021 FFCRA tax credit to the mailing address we use when filing. Please note that if you have any outstanding tax liabilities, the refund will first be used to offset the tax balance.

How long does it take to receive my refund?

The IRS may take up to three weeks to confirm the acceptance of your FFCRA credit application, and subsequently, it can take up to 20 weeks from that acknowledgment to receive your refund through either a check or direct deposit.

Are there any deadlines for claiming the FFCRA tax credits?

Certainly, the deadline for amending your 2020 and/or 2021 tax return to claim or adjust FFCRA credits is three years from the original due date of the return or within two years from the date you paid the tax, depending on which is later. For filing the FFCRA tax credits for your 2020 tax return, the deadline is April 15, 2024, and for your 2021 tax return, it is April 15, 2025.

Is FFCRA a loan or a grant?

FFCRA represents a tax credit rather than a loan and is not classified as a grant; rather, it functions as a reimbursement of taxes already paid. The intention behind these tax credits is to address expenses similar to those covered by mandatory paid leave for employees. If you find yourself unable to work due to COVID-19-related illness, caregiving responsibilities, or other conditions hindering your ability to work, these credits are designed to provide compensation for the income you've lost.

Does filing for FFCRA tax credits have any impact on filing my 2023 income taxes?

Claiming the FFCRA tax credit will not affect the filing of your 2023 annual income taxes. Our team of CPAs will initiate the process of amending the taxes you previously filed for the years 2020 and 2021 to facilitate the receipt of FFCRA tax credits.

How can I claim the FFCRA tax credits?

To secure the FFCRA tax credits, it's essential to assess your eligibility and modify your 2020 and/or 2021 tax returns along with their supporting schedules. While opting for this amendment, it is advisable to engage a Certified Public Accountant (CPA) for optimal outcomes. However, this process can consume significant time and financial resources. Alternatively, click the "Get Started" button in the top right corner of your screen, respond to the pre-qualification questions, and let 1099 Together handle it for you! Our team of CPAs has developed the quickest, safest, and most user-friendly tool for self-employed individuals and sole proprietors to effortlessly claim the federal FFCRA tax credits they are entitled to.

What should I expect after submitting the application to the IRS?

The IRS is currently addressing a backlog of amended Form 941 filings, owing to the Employee Retention Credit and the Families First Coronavirus Response Act. As a result, there may be a prolonged waiting period before you receive your refunds. Typical wait times vary, with averages often falling within the range of 5 to 8 months for new applications.

How can I monitor the status of my FFCRA refund?

To check your refund status, you can directly contact the IRS at (877) 777-4778. Our Customer Support team is also available for updates during your refund process.

Why should I work with a refund specialist?

The tax code, spanning over 70,000 pages, is too vast to master comprehensively. Our expertise lies specifically in FFCRA & ERC Tax Refunds. This specialization can be likened to the difference between a general practitioner and a neurologist. By concentrating exclusively on this program, our strategic partners possess a deep understanding of the nuanced details, allowing them to proficiently assess your eligibility and precisely calculate your refunds.

FICA Together Partner

Together Partner is powered by a customer centric mindset, top-of-the line talent, and experienced leadership from the world's most trusted brands. That’s how we’re able to achieve our mission of helping thousands of businesses across the country.

When it comes to alliances, we look for the same thing we look for in our employees: trusted, talented people.